Facts About Stonewell Bookkeeping Revealed

The Stonewell Bookkeeping PDFs

Table of ContentsThe Ultimate Guide To Stonewell BookkeepingStonewell Bookkeeping Things To Know Before You Get ThisStonewell Bookkeeping Can Be Fun For AnyoneStonewell Bookkeeping Fundamentals ExplainedSome Known Factual Statements About Stonewell Bookkeeping

Most lately, it's the Making Tax Obligation Digital (MTD) initiative with which the federal government is expecting services to abide. Low Cost Franchise. It's specifically what it states on the tin - organizations will have to start doing their tax obligations electronically via the usage of applications and software program. In this case, you'll not only need to do your publications however also utilize an app for it.You can rest simple recognizing that your service' monetary details is ready to be examined without HMRC offering you any anxiousness. Your mind will certainly be at convenience and you can focus on various other locations of your business.

-resize.jpg?token=0fac00d8975a85036711fd992adadc83)

What Does Stonewell Bookkeeping Do?

Accounting is essential for a tiny service as it aids: Display economic health and make notified choices, including cash circulation. Mobile accountancy apps offer several advantages for little organization proprietors and business owners, simplifying their monetary management jobs (https://244636314.hs-sites-na2.com/blog/why-bookkeeping-is-essential-for-your-business-success).

Numerous modern audit applications enable individuals to connect their savings account straight and sync the deals in real time. This makes it less complicated to keep an eye on and track the earnings and expenditures of the business, removing the need for manual entry. Automated attributes like invoicing, cost tracking, and importing financial institution transactions and bank feeds conserve time by reducing hand-operated data access and streamlining accounting procedures.

.jpg?token=7cd2150746d7a6091d181e6f1b4de871)

Additionally, these applications minimize the need for hiring additional personnel, as many tasks can be managed internal. By leveraging these benefits, local business proprietors can improve their economic management processes, boost decision-making, and concentrate extra on their core business operations. Xero is a cloud-based accounting software that helps small services conveniently manage their audit documents.

That "rewarding" client might actually be costing you cash as soon as you aspect in all costs. It's been haemorrhaging money for months, yet you had no means of understanding.

Getting My Stonewell Bookkeeping To Work

Due to the fact that they're making choices based on solid data, not price quotes. Your accounting exposes which services or products are truly successful, which customers are worth keeping, and where you're investing needlessly. https://blogfreely.net/hirestonewell/jqaqldp44g.

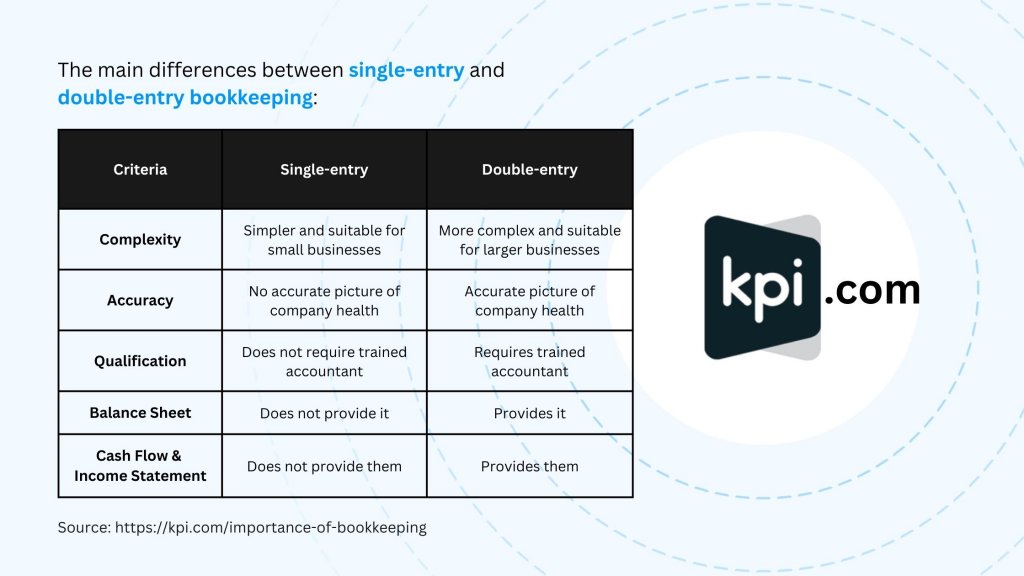

Presently,, and in some capacity. Just since you can do something doesn't indicate you should. Below's a sensible contrast to help you make a decision: FactorDIY BookkeepingProfessional BookkeepingCostSoftware charges just (less expensive upfront)Solution fees (generally $500-2,000+ monthly)Time Investment5-20+ hours per monthMinimal testimonial reports onlyAccuracyHigher error danger without trainingProfessional accuracy and expertiseComplianceSelf-managed threat of missing requirementsGuaranteed ATO complianceGrowth PotentialLimited by your available timeEnables concentrate on core businessTax OptimisationMay miss reductions and opportunitiesStrategic tax obligation planning includedScalabilityBecomes frustrating as organization growsEasily ranges with company needsPeace of MindConstant fret about accuracyProfessional assurance If any of these noise acquainted, it's probably time to bring in a specialist: Your service is growing and transactions are multiplying Accounting takes more than five hours regular You're registered for GST and lodging quarterly BAS You utilize team and manage pay-roll You have several revenue streams or savings account Tax obligation season fills you with genuine fear You 'd rather concentrate on your real imaginative work The reality?, and expert accountants recognize just how to leverage these tools efficiently.

Not known Factual Statements About Stonewell Bookkeeping

Maybe specific projects have much better repayment patterns than others. Also if offering your business seems distant, preserving tidy financial documents builds business value.

You could additionally overpay tax obligations without proper documentation of reductions, or face difficulties throughout audits. If you find errors, it's important to remedy them without delay and change any kind of afflicted tax lodgements. This is where specialist bookkeepers confirm important they have systems to catch errors before they come to be costly problems.

At its core, the main difference is what they perform with your economic information: manage the daily jobs, including recording sales, expenditures, and financial institution settlements, while keeping your basic ledger up to date and exact. It's about obtaining the numbers right regularly. action in to analyse: they take a look at those numbers, prepare economic statements, and translate what the data in fact suggests for your organization growth, tax obligation position, and success.

Everything about Stonewell Bookkeeping

Your business choices are just just as good as company website the documents you carry hand. It can be tough for entrepreneur to independently track every cost, loss, and earnings. Preserving accurate records calls for a great deal of work, even for small businesses. Do you understand how much your company has invested on pay-roll this year? How about the amount invested in stock up until now this year? Do you recognize where all your invoices are? Service taxes are intricate, time-consuming, and can be difficult when attempting to do them alone.